south san francisco sales tax rate 2021

Method to calculate South San Francisco sales tax in 2021. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

For questions regarding property tax collection please call 650 363-4142.

. The minimum combined 2022 sales tax rate for South San Francisco California is. The San Francisco Tourism Improvement District sales tax has been changed within the last year. The South San Francisco sales tax rate is.

In San Francisco the tax rate will rise from 85 to 8625. The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 250 special district sales tax used to fund transportation districts local attractions etc. City of South San Francisco.

The California sales tax rate is currently 6. The California sales tax rate is currently. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected.

New Sales and Use Tax Rates Operative July 1 2021 Created Date. Property taxes are collected by the County Tax Collector for the City and various other taxes are collected by the State and remitted to the City. Santa Clara County This rate applies in all unincorporated areas and in.

For tax rates in other cities see. Did South Dakota v. The San Francisco County California sales tax is 850 consisting of 600 California state.

The phone number for general tax questions is 1-800-400-7115. What is the sales tax rate in San Francisco California. 5192021 120245 PM.

As of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and. Sales Use Tax Rates. The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco.

San Francisco County collects on average 055 of a propertys assessed fair market value as property tax. The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes. San Francisco has parts of it located within San Mateo County.

South Shore Alameda 10750. The San Francisco County sales tax rate is. Go to our website at.

The South San Francisco California sales tax is 750 the same as the California state sales tax. The County sales tax rate is. The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925 to 9375 in July 2021. Method to calculate South San Francisco sales tax in 2021.

The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022. The average cumulative sales tax rate in San Francisco California is 864. Wwwcdtfacagov and select Tax and Fee Rates.

The average sales tax rate in California is 8551. The average sales tax rate in California is 8551. This is the total of state county and city sales tax rates.

Most of these tax changes were approved by. Has impacted many state nexus laws and sales tax collection requirements. The Sales and Use tax is rising across California including in San Francisco County.

To review the rules in California visit our state-by-state guide. South San Francisco 9875. Method to calculate San Francisco sales tax in 2021.

This includes the rates on the state county city and special levels. The 2018 United States Supreme Court decision in South Dakota v. What is the sales tax rate in South San Francisco California.

You can print a 9875 sales tax table here. The December 2020 total local sales tax rate was 8500. The South San Francisco California sales tax is 750 the same as the California state sales tax.

The County sales tax rate is. 4 rows The current total local sales tax rate in South San Francisco CA is 9875. The minimum combined sales tax rate for San Francisco California is 85.

Within San Francisco there are around 39 zip codes with the most populous zip code being 94112. 1788 rows California City County Sales Use Tax Rates effective April 1 2022.

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

States With Highest And Lowest Sales Tax Rates

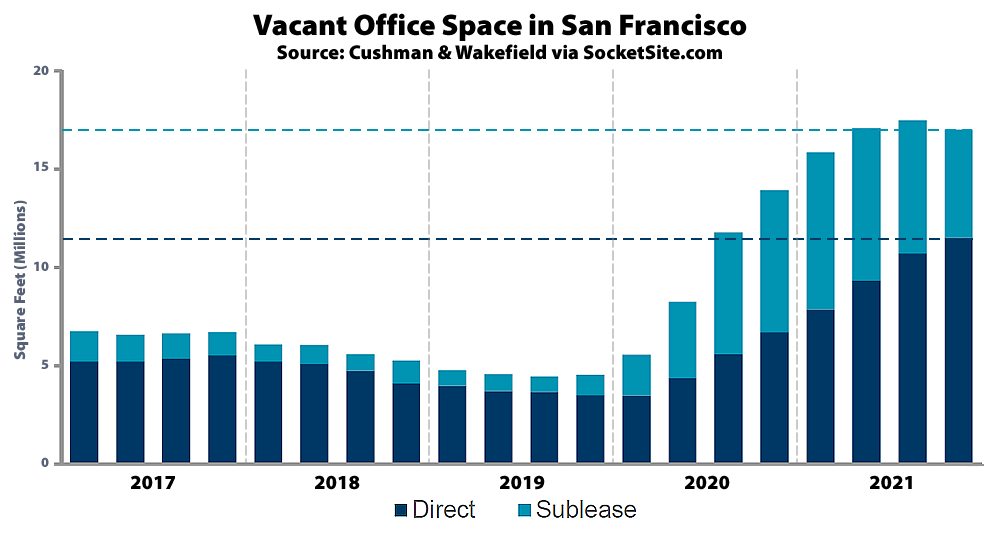

Office Vacancy Rate In San Francisco Inches Down But

Secured Property Taxes Treasurer Tax Collector

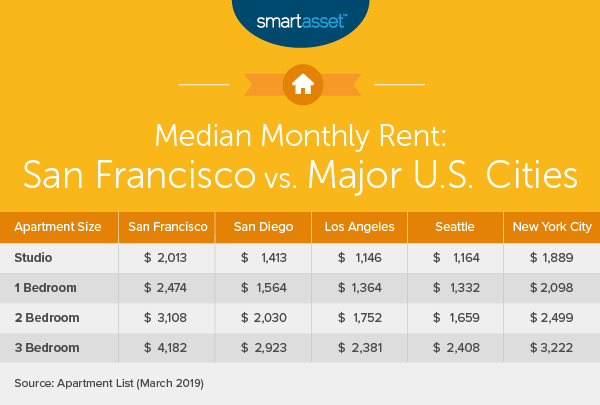

Why Households Need 300 000 To Live A Middle Class Lifestyle

Understanding California S Sales Tax

California Sales Tax Guide For Businesses

Sales Tax Rates In Major Cities Tax Data Tax Foundation

California Sales Tax Rates By City County 2022

California Sales Tax Small Business Guide Truic

Chicago Il Cost Of Living Is Chicago Affordable Data

Transfer Tax In San Mateo County California Who Pays What

Finance Department City Of South San Francisco

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Understanding California S Sales Tax

What Is The True Cost Of Living In San Francisco Smartasset

California City County Sales Use Tax Rates

Stripe Offers Cash To Workers Willing To Leave San Francisco Will Other Companies Follow San Francisco Business Times